“On behalf of the future, I ask you of the past to leave us alone.

You are not welcome among us. You have no sovereignty where we gather”.

- John Perry Barlow, EFF

Spotify is not the enemy you’re looking for

The success of a small group of players in a value chain tends to look pretty obvious once you figure out where the chain is most narrow or constrained. Companies operating at or near the constraint enjoy leverage over the companies that make up the rest of the value chain, so they get to help themselves to most of the profits. But every now and again, a new technology shifts the primary constraint elsewhere, sowing the seeds of disruption.

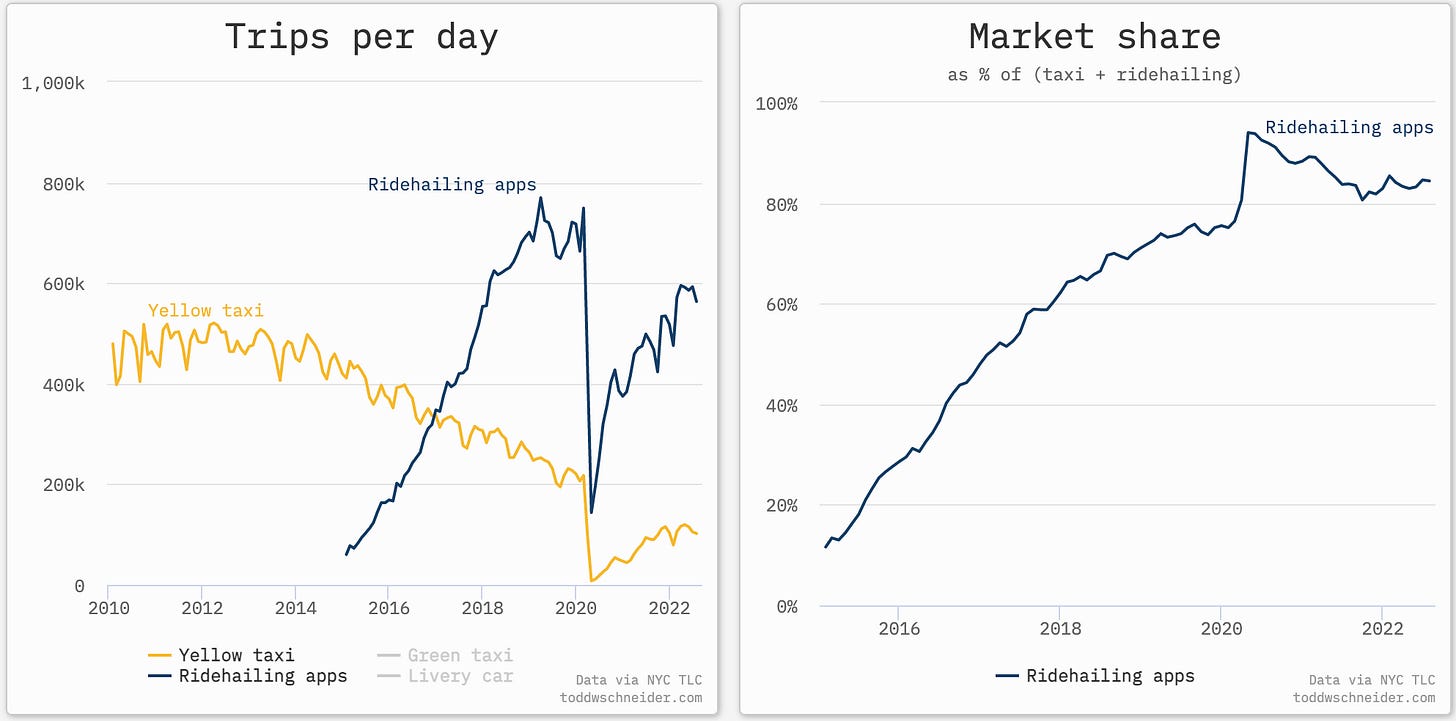

In 2009, Uber built leverage over incumbent taxi companies by using smartphones, GPS, and the internet to attract riders with virtual hailing and on-demand rides. Combining GPS with smartphones removed the physical proximity previously required to hail a taxi and allowed anyone with a car to be a taxi driver, removing the supply constraint.

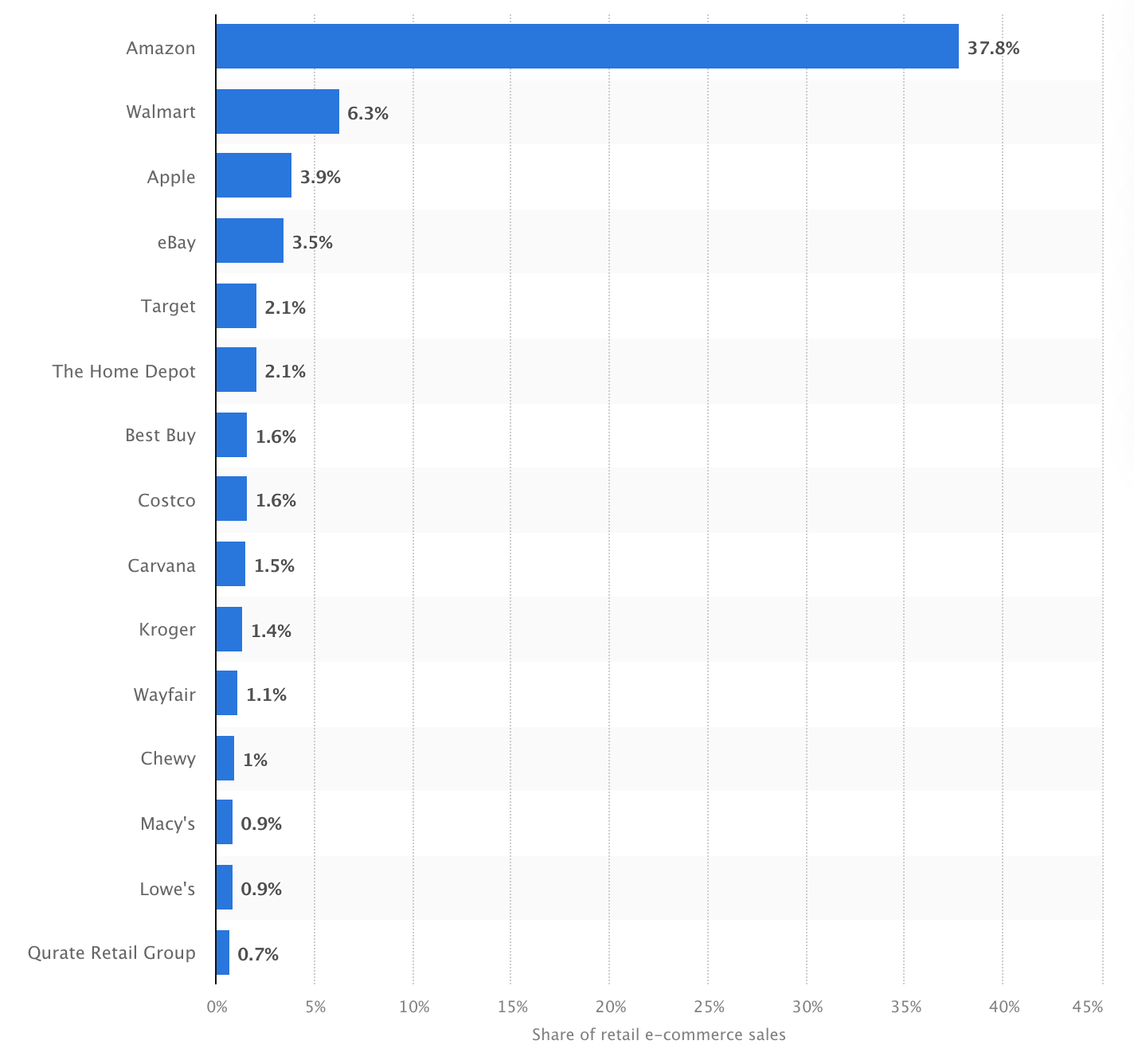

A decade earlier, Amazon used the internet to build leverage over incumbent retail stores, amassing a large customer base of online shoppers by offering a virtually unlimited selection of products and fast delivery. The internet removed the constraint that physical shelf space and proximity to customers had historically placed on a retail store’s product offering.

In both cases, this leverage was so absolute that Uber and Amazon both disrupted the incumbents, taxis and retail stores, respectively, and enjoyed increased power over the suppliers in each market, drivers and merchants.

Spotify managed to do something similar in 2008 with streaming music, building enough horizontal leverage to disrupt iTunes’ download model and eventually force Apple to adopt subscription streaming. Streaming removed the somewhat arbitrary ownership requirement previously required to listen to a song over the internet, freeing fans to listen to any song in the world for a monthly fee.

Despite taking a similar approach to Uber and Amazon, Spotify does not enjoy overwhelming vertical leverage over its suppliers. Though streaming removed the constraint on consumption in the music value chain, the primary constraint today is copyright ownership. Of the 8 million people that uploaded music to Spotify in 2021, only 203k, or 2.5%, earned over $1k. The majors, collectively, represent the rights of the 1000 or so artists whose music receives the most plays every day.

Ownership of revenue-generating copyrights is where most of the leverage lies in the music value chain. The majors monopolize these rights, giving them leverage over the entire value chain. As a result, Spotify has less say in your favorite artist’s Spotify earnings than you’d assume.

But NFTs, like all technologies prior, have a habit of shifting the primary constraint in the value chain elsewhere. In my opinion, NFTs:

lower the cost of creating assets, birthing non-traditional asset markets

lower the cost of maintaining digital relationships without an intermediary

lower the cost of capital formation

Notice that neither of these has much to do with music consumption. I’d argue that NFTs are not disruptive to Spotify’s business in the short-to-medium term.

Assuming I’m at least directionally correct, we should see web3 music competing at the “ownership of revenue-generating copyrights” section of the value chain through the creation of non-traditional music assets. But scanning the music web3 market today, I get the sense we could be sleepwalking into a repeat of the mistakes of our predecessors.

Summoning the Demon

If you’re a builder in music web3, I’m talking to you.

Please remove the music from your music NFTs.

Music NFTs, in their current form, act as wrappers around an asset that’s been fought over for centuries—copyright. Copyright is business-as-usual for the incumbent music industry, specifically the major labels. I, for example, wouldn’t expect to win a fight with Thor by attacking him with his own hammer.

A music NFT, a token whose metadata points to a URL, could point to anything that can be represented digitally, limited only by our imaginations. But once our music NFTs point to a music file, they inherit the rules of the system they hope to offer an escape from. How can we expect to establish a better system if we begin by rebuilding the old one?

Once music is “in” an NFT, playing the music to people through a website, allowing them to download the file, or simply selling the NFT without securing the appropriate licenses from every single copyright holder of every single song renders you the operator of an unlicensed music service.

As music copyright becomes the primary value proposition for the users of your project, you provide the incumbents increasing leverage over your project. The more success you have, the more music you attract, the greater the leverage they gain—and all this for free. The entanglement and opacity of rights created in the highly collaborative music creation process work to the incumbent’s advantage; you’ll infringe on someone’s rights as soon as you give your users an upload button.

By now, I assume it’s obvious, but it’s worth stating clearly. I believe that Music NFTs that contain a link to a Music file are a sustaining innovation relative to the incumbents, i.e., no disruption. If this becomes the dominant practice, I predict that Music NFTs will eventually be dominated by the majors, as all previous music-based innovations have. I could be wrong, of course, but I always like to increase my odds of success wherever possible, and I believe disruptive approaches exist.

In “To Have No Juice”, I argued that our nascent industry must disrupt the major label paradigm. To do that, we must build businesses they are unable to replicate and serve customers they are unable to reach or do not value. I want to offer some thoughts on how we might do that.

Seizing the memes of production

One of the most disruptive innovations of blockchains is their ability to secure property rights without the need for centralized institutions like governments. NFTs are often characterized as digital property.

It makes sense, then, that profile picture NFTs, digital collectible NFTs, and gaming NFTs are highly valuable and many times larger than music NFTs. These NFTs represent digital assets where most of the value is consumed digitally. On the other hand, music copyright has an entire industry dedicated to exploiting it (there are no PFP majors, for example). If music NFTs are just a wrapper for music copyright, they’ll forever have to compete with vanilla copyright markets.

What excites me about the NFT opportunity in music is the vision of a more equitable, creative, experimental music industry. I would love to think we can build it by simply issuing music as NFTs, but, as I explained above, it seems unlikely if we don’t help artists create some leverage of their own. That means new markets and revenue streams; to do that, we’ll need to get creative. I see three opportunities:

Building new, non-copyright revenues: A combination of new products and experiences built around digital-native rights

Collectibles: Collections designed around a theme related to a release

Comment Rights, e.g., Sound: The right to comment on a song cross-platform

Private/Public Message Rights: The right to send a message to an artist publicly or privately

Post-to-Feed/Feed Takeover Rights: The right to post to an artist’s feed or takeover a social channel for a limited time

Curation/Playlisting Rights: The right to curate an artist’s playlist, the right to curate an artist’s music across platforms

Follow/Notification Rights: The right to receive updates from an artist

Community Role-based Badges: The right to perform a set of activities within a community, e.g., voting, promotion, announcements, hosting, etc.

Cross-platform, Token-gated Content: The right to access private content across multiple platforms

Token-gated Access: The right to access private communities and digital spaces

Financial Products

Buyback Tokens: Artists buy back tokens they issue to supporters to raise funds for a project

A&R Funds: Compete directly with the labels to develop talent

Catalog Acquisition Funds: Compete directly with labels and publishers for catalog

Artist Collectives: Multi-disciplinary collectives that issue an ERC20 and cross-sell NFTs, access, collections, artwork, and products to a group of token holders organized around genre, location, brand, or theme

Free Music

Exiting Copyright: A platform that allows artists to release music under CC0

These can also be combined. Imagine, for example, a platform that allows artists to assign their rights to the platform, collects any copyright royalties the artist generates, reports it to token holders, and uses the revenue to buy the artist’s NFTs.

It’s worth noting that you can pursue all of these opportunities without linking to music from your music NFT.

There are definitely valid counterarguments. By allowing collectors and speculators to fund new artists by buying music NFTs that contain music, artists will enjoy a stronger bargaining position versus labels (more rights buyers) or avoid selling rights altogether, thereby weakening the label’s position over time. At some point, music NFTs take over as the primary mechanism for investing in copyright. However, this is functionally equivalent to the independent label and distributor model, which, without billions of dollars, makes it unlikely to ever challenge the major’s position and will eventually be co-opted by the majors through M&A.

In a recent debate about this article, a friend reminded me that the outcomes of technology-based innovation are almost impossible to predict beforehand and that I should be mindful when making recommendations about the future. However, I believe that ideas are powerful and can change the future, so if there’s only one idea you take with you today, it is this:

If you’re working on anything in the space, I’d love to speak to you. DMs are open. Please reach out.

Be very careful when you are suggesting "non copyright" IP be available to the masses (and please correct me if I'm wrong about what you're suggesting here). I don't think you are informed enough about exactly HOW artists of all kinds (not just musical) make a living - in the end, their IP is ALL THEY HAVE of value.

I'm sure you've seen major artists like Springsteen and Dylan sell their massive, extremely valuable music catalogues to private buyers via platforms like Hipgnosis - if they did not own their IP (even worse, if they never copyrighted their music) they would NOT have a music catalogue to sell towards the end of their illustrious careers (clearly they also did not allow their labels to own most/all of their IP during their careers, or they were able to leverage to buy the rights back at some point.).

I agree that music/IP ownership should not be attached to this newfangled format called NFTs, but for totally different reasons. And, with the recent news that those who want to cash in on someone else's work have figured out how to get the royalty producing stipulation out of the smart contract attached to every NFT (WTF? This was one reason I was getting excited over the format - because for ONCE, artists actually had control/ownership of their IP and could benefit from the selling/trading of it in the years ahead) I am now OUT. Shelving this format completely in my mind and not pushing it to anyone going forward unless/until that hack is resolved, which I hear is being worked on through new protocols, but honestly if it's that easy to negate a smart contract with these things, forget it. I'll wait for something that's truly revolutionary FOR ARTISTS and not just a marketing ploy/come-on/get rich quick scheme (not for them of course) to get them to waste precious time/energy on what's basically just a new version of the same ol' same ol' (ripoff).

Sooooooo utterly disappointed in what these things have turned into in such short notice. As an artist's advocate, it's gone from possible new paradigm to total fail in my eyes.

PS I work in the music business. At a major. And my daughter is an indie recording artist. I also have a bit of crypto background to my resume. So I'm looking at these things from all sides.

PSS Here's YouTube attempting to make sure the original artists (IP holders) are compensated for their art being used by others via licensing, and a way for "creators" (ie users, those who make and post vids on YouTube) to legit license that IP and/or participate in a revenue sharing model. https://techcrunch.com/2022/09/20/youtube-announces-creator-music-a-new-way-for-creators-to-shop-for-songs-for-use-in-videos/. Read and learn, and become part of the solution instead of the time immemorial problem of others trying to find ways to rip off artists/IP/legit copyright holders.

We're building in Music Web3 - a whole new composable system of creation & distribution, built on top of AR location tech stacks like Niantic Lightship (Pokemon Go), ARKit (Apple), and Cloud Anchors (Google). IMMUSE = Immersive Music, and we enable "location staking" to connect music visuals to specific locations, and have all copyrights signed off before creation as a "metaverse sync license".

Here's how we compare the traditional music Licensing structure to the new Web3 Ownership structure - most importantly putting creators back at the center of the industry AND pulling fans into the formal structure for the first time. "Fan collaboration" is the next level of fanship, leveraging new ownership incentives around NFTs for the benefit of the music.

https://docs.google.com/presentation/d/1n8H1UvD0pE7MPHxMsNAHnAtWMhe_fBZCrpYMSA1fKzY/edit?usp=sharing