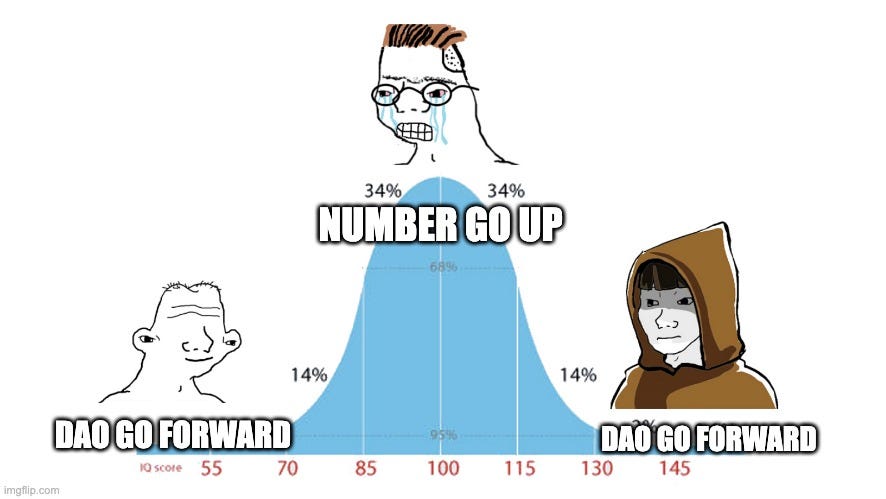

Less Number Go Up, More DAO Go Forward

Unf*cking DAOs for the public good

Following my last post, How to think about DAOs, I’d now like to take a more critical view of DAOs.

I finished that post with the realisation that DAOs have taken on the difficult task of providing public goods without the financial flexibility enjoyed by governments and, even worse, have a structural exposure to being ruled by the wealthy. I’ll now spend some time highlighting the perils of rule by the wealthy, why it matters for DAOs, and offer some thoughts on a solution.

Why DAOs Fail

In “Why Nation’s Fail”, the authors argue that nations fail when their institutions, “a set of formal and informal rules and mechanisms for coercing individuals to comply with these rules that exist in society (Wikipedia)”, come to represent a single group’s interests, typically the elites.

Once in power, this group siphons wealth away from other groups, dulling any incentive to innovate, and blocking any threats to their wealth. The result is stagnation.

When a plan to build a northern railway was put before Francis I, he replied, “No, no, I will have nothing to do with it, lest the revolution might come into the country.”

Where a nation’s institutions are inclusive, representing the interests of broad, diverse segments of society, it is difficult for any single group to subvert the machinery of the nation to serve themselves alone. A nation’s success, therefore, relies on a delicate internal balance of power and competing interests. No group’s power can be allowed to go unchecked.

Bitcoin, Ethereum, and other DAO-like organisations offer an alternative vision for our institutions. We can catch glimpses of this future today, with blockchain protocols operated by decentralised online communities vying to be one-for-one replacements for traditional public services, e.g. intellectual property registries and currency, and governments using blockchains to enhance their offerings. The resulting arms race, we expect, delivers increasingly higher quality, lower cost goods and services, as we see with decentralised finance services like Compound, Maker, and Aave.

These networks are valuable precisely because they are difficult to subvert. Bitcoin and Ethereum run, for the most part, leaderlessly. They’re expensive to attack, resilient when under attack, and difficult to corrupt. Both can be accessed by anyone, anywhere in the world with an internet connection, and provision their services indiscriminately for many sections of society.

Regrettably, many of the organisations that bear the label ‘DAO’ do few or none of the above and could (and probably should) exist as traditional corporations. But let’s pretend those DAOs don’t exist for the moment.

For DAOs that should be DAOs—those where decentralisation, or the internal balance of power, is a positive and necessary force—we’re stuck with an unfortunate trade-off.

Number Go Up

In June, Chainalysis launched their State of Web3 report showing that DAO ownership is currently concentrated in the hands of a relatively small group of well-capitalised organisations. These organisations are slowly amassing control over critical pieces of on-chain, public goods infrastructure, including L1s, L2s, staking, NFTs, and finance.

In some cases, these organisations together possess the voting power to both create and pass proposals unopposed and, without a credible mechanism to act as a limit on their power, DAOs are increasingly prone to decisions that favour the wealthiest holders over-and-above decisions that best serve the public.

As an example, I followed the recent Head Chef hiring process at Sushi. The final decision was put to a token vote which was ultimately decided by two voters from a total of 391 voters.

As Thomas Ferguson proposed in his 1983 paper, Party Realignment and American Industrial Structure: The Investment Theory of Political Parties in Historical Perspective, the best strategy for a Head Chef candidate would have been a direct appeal to the interests of the wealthiest holders, not the users, not the liquidity providers, nor the team.

Left unaddressed, this represents a failure mode for DAOs, the effects of which could limit their ultimate success. Should a user believe a public good’s governance may be biased against them, they will limit their usage to avoid the costs they’ll incur should the rules be changed without their consent. Flooding DAO governance with people who only care about “number go up” guarantees your DAO will always choose to divert resources from things that support users to things that support token price.

Even worse, failure here risks forfeiting an exciting, emergent design space for institutional innovation and propagating more of the same extractive practices web3 promised an escape from.

It’s no accident that both Ethereum and Bitcoin employ off-chain governance. Ethereum’s cofounder, Vitalik, has often criticised token voting as a governance mechanism, citing whale preferences, tragedy of the commons, underrepresented constituencies, opaque conflicts of interest, and vote-buying as issues.

There are a few good counterarguments here. One is that delegation mitigates the effects of whale voters by allowing smaller token holders to delegate governance rights to a representative. But delegation is expensive to implement and adopt, even more expensive to retrofit, and onboarding voters to a delegated voting system has to run the same voter apathy gauntlet as regular voting.

A second is reputation or ex post settling up, where the risk of opportunism or corruption is constrained by the costs levied on the perpetrator by the market after the transaction. This could include reduced business opportunities or lower wages—as an example, consider the future employment prospects of a CEO caught embezzling corporate funds.

But reputation is often built through narrative not facts, which are easily obscured. The wealthy possess a powerful combination of low cost of coordination (barriers), large stores of wealth (capability), and high risk (incentives) to control their reputation and protect downside risk.

A third solution lies in simply restricting the governance surface area to DAO parameters that are resistant to opportunism, e.g. the colour of the logo.

But restricting the governance surface area only works well where a project is functionally complete and governance can be designed as a component of the overall system. However, many projects launch governance tokens at inception, delegating to a community of token-holders to decide how a project is realised. In this community-bootstrapped approach, token-holders require maximum discretion. From here, unless compelled by another force, token-holders will always vote to enshrine their discretionary power before they vote to limit it.

Each of these solutions offer DAOs some freedom to sell governance tokens to the highest, largest bidders, safe in the knowledge that there are opposing forces at work to balance the resulting concentration of power. But there are no hard guarantees.

So what can we do?

DAO Go Forward

To counteract the effects of “number go up” voters, we need to add a group with complimentary incentives to act as a check on their power. Let’s call these people, “DAO Go Forward” voters. Finding and securing the help of this group is not simple, however, a viable solution lies in DAO financing.

All DAOs need financing of some kind. We already know that DAOs sell governance rights to secure finance, and that this concentrates governance rights in the hands of the wealthy. But if we separate governance rights and economic rights, as we do in vote delegation, DAOs can sell economic rights without the underlying governance rights. We see a similar instrument used by corporations with preferred shares, which carry no voting rights but have a first claim to the company’s assets and dividends ahead of ordinary shares, acting more like debt than equity.

Selling economic rights without governance rights, or pre-delegated governance tokens, allows DAOs to raise as much financing as they need without concentrating governance rights in the hands of the wealthy.

Now we’re left with a pool of governance rights that we’re free to delegate to whoever we want. Here we summon our hypothetical “DAO Go Forward” voters. We could delegate these votes to one person with a single focus like risk management and compensate them to do this job on the DAO’s behalf, or allocate it to a group that represents a particular set of users across many DAOs, like DAO contributors. We could even decide that these tokens do not vote for periods of time or on particular issues—or that the tokens will be delegated fractionally across existing delegates according to an algorithm.

Rather than deciding this up-front, we could simply delegate the tokens to a smart contract and give the transacting DAO the ability to design their own governance rules, test them in these smaller groups, and iterate as much as they want until the DAO behaves as expected. There are plenty of ideas to explore here to attract the correct mix of “DAO Go Forward” voters to keep the “Number Go Up” people in check.

This solution extends the governance design space for DAOs, allowing them to iterate on the ideal distribution of governance rights and economic rights, while financing their operations.

Dequity

Oliver Williamson introduced the idea of Dequity in a 1988 paper where he argued that an instrument that possessed the properties of both debt and equity—rules-based under normal conditions with a provision to allow the rules to be abandoned at the holder’s discretion—should outperform either instrument alone. I originally came across the concept when reading Understanding the Blockchain Economy by Chris Berg, Sinclair Davidson, and Jason Potts.

Williamson, however, concluded that without the ability to enforce the conditions under which the rules could be abandoned, dequity would be too open to abuse.

Put differently, the admonition to "follow the rules with discretion" is too facile. Since to combine rules with discretion will never realize the hypothetical ideal but will always entail compromise (source)

I’ve claimed that selling governance rights is the wrong financing mechanism for DAOs. I’ve suggested that because DAOs provide public goods like governments, we should look at how governments are financed and concluded that DAOs would benefit from a separation of governance rights and economic rights as we see in nation-states, Bitcoin, and Ethereum.

By isolating each right, rules-based economic rights and discretionary governance rights, we can produce better outcomes for DAOs. Coincidentally, the solution outlined above gives DAOs access to a dequity-like instrument. One that allows them to issue an asset that is rules-based but under conditions enforced by a smart contract, can regain some or all of its full governance rights.

As Berg, Davidson, and Potts concluded, due to the “institutional characteristics of blockchain”:

Dequity (as a dominant financing instrument) is possible where promise is possible.

I’m willing to bet we can prove them right.