Who really owns your NFT

Uncontrolled NFTs and the Looming Threat of Violence

Non-fungible tokens (NFTs) are here.

And with them an influx of new artists, creators, and musicians, (and their fans?) to crypto, which means more users, more wallets, and more customers. These are the people I've longed to see joining the space… but something’s a little off.

Over the past few weeks, I've watched in awe as whales, chads, and degens have thrown net worth and/or stim checks at strangers in exchange for Ethereum-secured ownership of digital art, collectibles, video, audio, and combinations of all the above.

But there are some cracks appearing...

Turns out not all NFTs are created equal.

One particular tweet that caught my attention:

There is an incredibly blurry line wherever blockchains crash into the real world and, as most people seem to automatically equate the value in NFTs to the value typically governed and apportioned by Intellectual Property Rights, they're currently pretty hard to uncrash.

I’m not in a position to explain how copyright works in any detail or the legal implications of minting NFTs of creations you don’t own, but I’d like to suggest that NFTs are valuable independently of copyright and that exploring and developing true ownership of digital assets is the best possible path forward for this space.

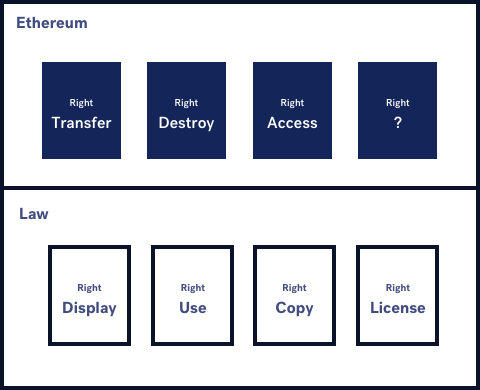

Generic Rights

Cryptocurrencies like ETH and BTC can really only be considered one thing: money. As Mr Szabo says:

Digital cash is a special case: money is the most generic of rights.

What I believe Nick is saying here is that by simply holding digital cash, the holder inherits all possible rights required for digital cash to perform the jobs we expect digital cash to do.

Mapping this to cryptocurrency:

When someone signs a transaction and broadcasts it to the Ethereum network…

...and a miner mines a new block containing that transaction into the blockchain…

....and the balance of ETH is reduced at one public address and increased by the same amount at a different public address…

...by simply holding the corresponding private key to that public address…

...without a shadow of a doubt…

…you inherit a set of inalienable rights within which the entire job of that cryptocurrency (in its role as a currency) can be performed.

Currencies are typically used for 2 jobs:

Store of Value

Medium of Exchange

The holder of a private key can do the following:

Nothing = Store of Value

Transfer to another address = Medium of Exchange

That's literally it. (One of the few cases where code... is pretty much law.)

NFTs though... well... it's tough to say. They’re messy.

You really need to look at each NFT independently, the smart contracts of the platform used to issue it, and their terms of service to know what you've actually bought.

Genesis

Genesis by trevorjonesart was one of my favourite NFT auctions to watch. It sold to Maxstealth for 302.5 ETH (~$111k then, >$578k as of March 13 2021).

By bidding on and winning this auction, the NFT issued by trevorjonesart to represent it was transferred to Maxstealth’s wallet. Maxstealth now owns this incredible piece of art. Well... not quite.

The contract that governs this NFT is here: https://etherscan.io/tx/0x260d204cd681b53cbd8ad1e541ce5ef467d55e25546c8b46ed4d6f534adf04a3 and is based on the ERC721 standard.

Once purchased, the owner of the public address listed as the from address owns a unique token with an id, some metadata, and gains access to a single method:

transfer (technically

safeTransfer)

Maxstealth has purchased the sole right to transfer this NFT to any other address on the Ethereum network (and explicitly cannot destroy it).

There’s a lot of talk about NFT metadata and whether the file is stored on-chain or on AWS somewhere, and how this relates to the copyright. It’s an interesting conversation but the most important part of this story is the role of Makersplace. The glue holding this transaction and any future transaction together.

Taking a closer look at the Makersplace FAQ, we see the following:

What am I buying?

You're buying a limited edition digital creation, signed by the creator. Upon purchase, you'll be given the right to use, distribute and display the creation for non-commercial purposes. Since you own this unique creation, you can also re-sell the same non-commercial use rights, to the creation, on a secondary market or even directly on MakersPlace.

Upon purchase, you can access the high resolution digital file which you can display on any digital device or even print out, for personal use. All the while, knowing that you have the authentic piece, verifiable on the blockchain.

It's important to clarify what's going on here. By purchasing an NFT on MakersPlace, you will 100% be transferred ownership of the cryptoasset in question, and that gives you the inalienable right to transfer it to another public address, i.e. sell it.

However, Makersplace’s FAQ alludes to a second implied transaction that must take place for you to acquire the actual set of rights that you may care about, i.e. where value traditionally comes from in media. Specific rights like the "right to use, distribute, and display the creation for non-commercial purposes" falls slap bang in the realm of Intellectual Property Rights, and more specifically Copyright.

Hence, Makersplace act as a centralised intermediary, mapping intellectual property rights from the law to the NFT.

This raises the question of centralisation and its growing role in the NFT marketplace.

Threat of Violence

Copyright operates like an invisible, persistent global mesh within which every person on the planet exists. When one of us creates something new the mesh springs into action, automatically assigning the creator a set of rights, including the right to wield whatever legal violence you can afford against anyone who dares to infringe them.

Messy metaphor aside, my point here is that ownership of an NFT, unlike ownership of a cryptocurrency, does not automatically grant you the specific rights granted by copyright unless all parties recognise and document that during the transaction, which Makersplace achieve via their Terms of Service.

Which does raise the question: What happens if Makersplace, at some point, is no longer in a position to enforce these contracts? Some NFTs may lose a significant amount of value if there isn’t an accompanying contract assigning the IP rights.

The ideal state would be some generic mechanism that allows us to design tokens that, by holding the associated private key alone, grant the holder all rights associated with whatever we wish to tokenise. However, what feels far more likely is that we end up with IP Rights bridges and hooks that operate across a variety of trust assumptions.

Bridges are like Coinbase and Binance. They sit at the edge of a network and facilitate access and representation under contractual agreements with users, providing custody for their assets and exchange between non-blockchain assets and blockchain assets.

Hooks are like WBTC and Mirror. They take custody of non-blockchain assets and represent them on-chain. This creates some centralisation and counter-party risk but extends the total set of buyers and sellers for an asset.

I see examples of both in the space today, and attempted to build some, and expect someone will eventually make great headway with some version of a Coinbase for Rights.

Controlled NFTs

The design space for NFTs is vast and we’re early on the curve. We need more work to design NFTs and NFT marketplaces that make NFTs function more like Cryptocurrencies, where the token alone transfers the set of rights that the NFT owner wants to sell and the NFT buyer expects to buy.

ETH provides an interesting example of this. All holders of ETH inherit the right to send Ethereum transactions. ETH holders need not rely on any external system to enforce this right, holding the token is the right.

Personally, I’d much rather we keep NFTs as far away from copyright as possible. I believe NFTs are valuable in their own right without transferring copyright or granting a license. If we imagine NFTs as digital objects alone and ignore the copyright, we may end up in a much better place.

Jack’s First Tweet NFT is literally just that: a token that represents Jack’s First Tweet signed by a private key that Jack Dorsey controls. No copyright, no license, just the token and what we all believe it represents. In 200 years, Twitter may be gone, or some drunk intern may have hacked into Jack’s account and deleted the original tweet. But the NFT will still be here.. and we’ll all know what it represents.

If the market continues to demonstrate that it values NFTs alone without the copyright, where the entire scope of the rights being sold is embodied within that transfer function, I think we’ve got the makings of something incredible.

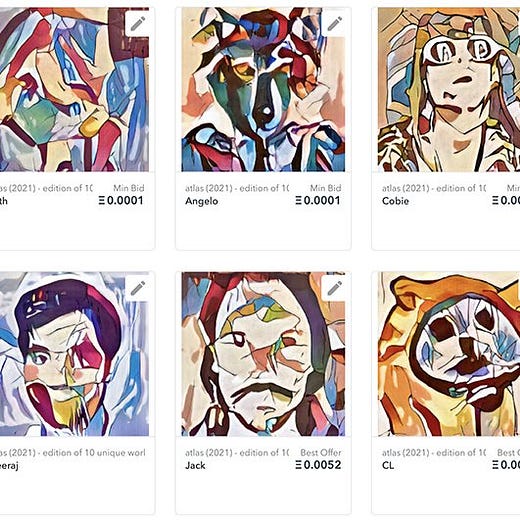

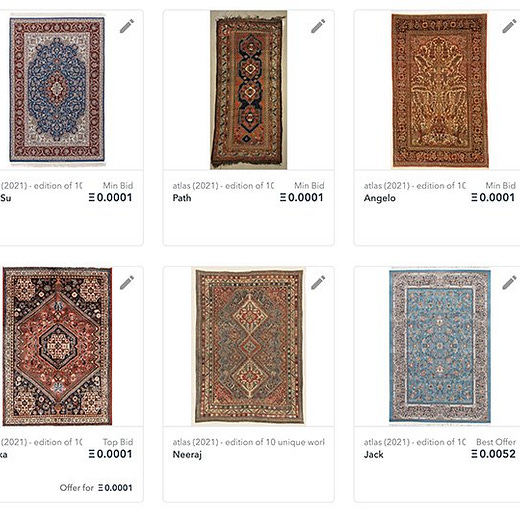

Great post. Funny thing is that the second twitter post is a fake "artist" who is just stealing pictures of rugs off the internet and selling them as his original work, claiming they were created from some special algorithmic program that turns portrait art into these rugs. I'm a certified Oriental rug appraiser and those are hand made rugs. A simple google search using their image matching tool shows them on Pinterest or the original sites.

That is why copyright exists in the first place. Along with patent and Trademark they are the basis of protection for intellectual property that are backed by the threat and reality of government violence. One must establish the "first" right to have a legal claim on it as with any property. Of course selling stolen or unverifiable property hasn't stopped IRL so that system isn't a perfect by any stretch and it fails much worse in a digital world.

Interestingly the algorithmic detection of abuse of digital rights has gotten very good but as you know the validity of the claim of that first right still has to be established. I do think that a market solution is possible and far more desirable than the centralized violence of government but it has yet to be done.

I absolutely believe that we are moving toward a day when everyone will deposit their content (or a hash) into an account (ZK?) to be used as part of a verification process for when others try to do the same. In the end I don't see that really replacing the need for judicial process in the case where both sides dispute. But it is a much better solution than what we have now and the dispute resolution process is a whole other subject.